Capitalcore Review

Capitalcore is a relatively new financial services provider, specifically a binary broker, founded in 2024. It operates under IFSA regulation, but detailed information about specific licensing authorities and numbers is not readily available in the public domain.

Regulatory Status

Capitalcore is regulated by the International Financial Services Authority (IFSA), indicating some level of oversight regarding its operations. However, detailed information about license numbers or specific regulatory conditions is not publicly disclosed.

Account Types

Capitalcore offers a range of account types and flexible banking options tailored to various trading needs and experience levels. Below is a detailed summary:

- Classic Account: Designed for beginners, offering access to full trading functionality with a low minimum deposit requirement.

- Silver Account: Geared for intermediate traders, this account includes enhanced benefits and higher leverage compared to the Classic account.

- Gold Account: Suitable for experienced traders, this account type provides additional perks like free VPS, dedicated account manager, and customized trading conditions.

- VIP Account: The premium option, best for high-volume traders, offering maximum features, top-tier customer support, and the most advantageous trading conditions including higher leverage and exclusivity benefits.

All account types support both Forex and Binary Options trading. The specific differences between accounts include varying minimum deposit amounts, leverage ratios, trading benefits, and access to additional services like account management and VPS hosting.

Banking Options

- Credit/Debit Cards: Accepts major cards for funding accounts.

- E-wallets: Various e-wallet services are supported for quick deposits and withdrawals.

- Cryptocurrency: Allows funding and withdrawals using popular cryptocurrencies, providing additional flexibility for global clients.

These banking methods are available for both deposits and withdrawals, catering to a wide range of user preferences and geographic locations.

Additional Features

- Maximum leverage up to 1:2000, depending on account type.

- Free VPS and dedicated account manager for Gold and VIP accounts.

- Customizable trading conditions for advanced accounts.

Account setup is straightforward, requiring basic personal information, proof of identity, proof of address, and proof of payment. Verification typically takes up to 48 hours.

Leverage

Capitalcore offers traders flexible leverage options, allowing leverage up to a maximum of 1:2000. However, the maximum available leverage is determined by the trader’s account balance and may be automatically adjusted as your balance changes. Traders can also customize their leverage settings via the online Client Cabinet for added convenience and trading efficiency.

Leverage Tiers by Account Balance

| Account Balance (USD) | Maximum Leverage |

|---|---|

| 1 - 999 | 1:2000 |

| 1,000 - 1,999 | 1:1000 |

| 2,000 - 2,999 | 1:500 |

| 3,000 - 4,999 | 1:400 |

| 5,000 - 9,999 | 1:200 |

| 10,000 - 29,999 | 1:100 |

| Above 30,000 | 1:50 |

For balances above $25,000 or $30,000, the maximum leverage is reduced to 1:50 as a risk management measure. The leverage table may show slight variations in upper balance bands as cited, but the overall leverage structure remains consistent.

Additional Leverage Features

- Traders can modify their leverage settings independently online for tailored trading conditions.

- Leverage is automatically adjusted based on your account balance to ensure compliance with Capitalcore’s risk policies.

- The maximum leverage of 1:2000 applies to both forex and binary options trading, depending on the chosen account type.

Capitalcore provides a flexible leverage structure up to 1:2000, with the allowable maximum decreasing as account balance increases. This system is designed to balance trading flexibility with responsible risk management on the platform.

Asset Types

Capitalcore is a multi-asset trading platform that provides access to a broad selection of financial instruments and markets. Here is an overview of what you can trade:

Major Asset Classes

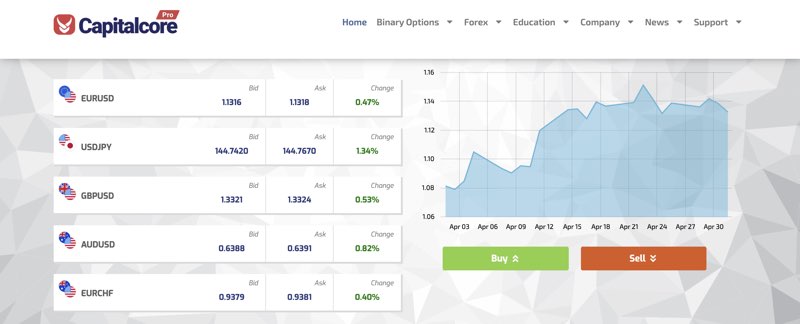

- Forex (Foreign Exchange): Trade a large variety of currency pairs, including all major pairs (e.g., EUR/USD, GBP/USD, USD/JPY), as well as minor and exotic pairs.

- Stocks: Trade major US, European, and Asian equities. The platform also provides access to trading the world’s largest stock indices such as the Dow Jones and NASDAQ.

- Metals: Gold and silver are available to trade as standalone assets or through binary options.

- Cryptocurrencies: Binary options trading is available on leading cryptocurrencies like Bitcoin and Ethereum.

- Futures: Access to futures trading is supported directly from the platform.

- Binary Options: Trade binary options on forex pairs, metals (e.g., gold), and cryptocurrencies.

Markets

- Forex market

- Stock market (global indices and individual stocks)

- Metals market

- Cryptocurrency market (via binary options)

- Futures markets

Key Platform Features

- Multi-platform support, including Windows, Mac, Linux, and mobile devices.

- Multiple trading systems (classic and advanced), serving beginners and professionals alike.

- Trading modes include instant, request, market, and exchange execution.

- Support for various order types: market, pending, stop, and trailing stop.

- Flexible binary options trading with expiration times from 60 seconds up to one hour.

In summary, Capitalcore is designed for traders looking to access a comprehensive range of assets, including forex, stocks, indices, metals, cryptocurrencies (via binary options), and futures—all through modern, feature-rich trading platforms.

Platforms

Capitalcore offers a comprehensive suite of trading platforms and tools designed to cater to both novice and professional traders. These platforms support a variety of assets, including Forex, stocks, futures, and binary options.

Trading Platforms Overview

- Multi-Asset Platform: This platform allows trading across multiple assets like Forex, stocks, and futures. It provides various order execution modes (Instant, Request, Market, and Exchange) and supports different order types (market, pending, stop, and trailing stop orders).

- Webtrader: Offers lightning-fast order execution and real-time market data. It is suitable for traders who prefer web-based trading.

- Binary Options Platform: Tailored for binary options trading, it is designed for both novice and experienced traders, providing simple and fast trading opportunities.

- Demo Account: Available for practicing binary options trading with virtual money, allowing traders to hone their skills without financial risk.

Operating System Compatibility

The Capitalcore platforms are compatible with a wide range of operating systems, including:

- Windows Platform: Compatible with most Windows versions.

- Macintosh Platform: Supported through MetaTrader 5.

- Linux Platform: Compatible with various Linux distributions.

- Mobile Platforms: Supports trading on mobile devices for convenience and flexibility.

Trading Tools and Features

Capitalcore's platforms are equipped with advanced tools to enhance trading experiences:

- Superior Price Analysis Tools: Providing comprehensive market insights for informed trading decisions.

- Advanced Analytical Tools and Indicators: Empowers traders to make precise trading strategies.

- Market Depth: Offers detailed market data for better decision-making.

- Education and Support: Extensive educational resources and 24/7 multilingual support for traders.

Fees

Capitalcore’s fee structure is designed to be transparent and straightforward, with the primary trading cost being the spread. Here is a detailed breakdown of the fees and trading costs users should expect:

Trading Fees

- No Commission Fees: Capitalcore does not charge commissions on trades. The only fee applied is the spread for the asset being traded.

- Spreads:

- Spreads vary by account type:

- Classic & Silver accounts: e.g., 5.5 pips spread for AUD/NZD

- Gold account: e.g., 3.0 pips spread for AUD/NZD

- VIP account: e.g., 1.5 pips spread for AUD/NZD

- Major forex pairs can have very tight spreads (e.g., 0.4–0.5 pips for EUR/USD, GBP/USD, GBP/EUR).

- Crypto spreads are wider (e.g., $45).

- CFD spreads vary (e.g., FTSE: 25, Apple stock: 1.5).

- Spreads vary by account type:

- No Swap Fees: Capitalcore does not charge swap (overnight holding) fees, which is beneficial for traders holding positions long-term.

- No Inactivity Fees: There are no inactivity fees for dormant accounts, so users will not be charged for taking a break from trading.

Deposit and Withdrawal Fees

- Deposits:

- Perfect Money: 1% deposit fee with a minimum deposit of $1.

- PayPal: No deposit fees, minimum deposit of $10.

- Withdrawals:

- PayPal: 5% withdrawal fee.

- Cryptocurrency: Users pay network fees, which vary by coin.

- All withdrawals are processed back to the original deposit source.

| Fee Type | Details |

|---|---|

| Commissions | None |

| Spreads (varies by account) |

Classic/Silver: 5.5 pips (AUD/NZD) Gold: 3.0 pips (AUD/NZD) VIP: 1.5 pips (AUD/NZD) Major FX: 0.4–0.5 pips Crypto: $45 Apple Stock: 1.5 |

| Swap Fees | None |

| Inactivity Fee | None |

| Deposit Fees |

Perfect Money: 1% PayPal: None |

| Withdrawal Fees |

PayPal: 5% Crypto: network fees |

Key Takeaways: Trading on Capitalcore is commission-free, with trading costs largely determined by the spread, which varies by account type and asset. There are no inactivity or swap fees. Deposit and withdrawal fees depend on the chosen payment method, with PayPal and cryptocurrencies potentially incurring higher costs.

Pros

- 24/7 Trading and Support: Capitalcore offers the ability to trade around the clock, including weekends, especially for assets like cryptocurrencies. Their customer support also operates 24/7, ensuring assistance is always available for any issue from registration to withdrawals.

- Flexible Deposit and Withdrawal Methods: Users can choose from a wide variety of funding and withdrawal options, both contemporary and classic, making it easy and secure to transfer funds in and out of accounts at any time.

- High Leverage: Capitalcore provides leverage up to 1:2000, allowing traders to maximize potential returns with minimal capital outlay, which is among the highest in the industry.

- No Commissions or Swap Fees: Trading on Capitalcore involves no commission or swap fees across instruments, which improves profitability and makes cost structures transparent for users.

- Low Minimum Deposits: The platform is accessible to new traders due to its low minimum deposit requirement, lowering barriers to entry.

- Wide Range of Tradable Assets: Capitalcore supports trading in a broad selection of instruments, including major and minor forex pairs, stocks, indices, metals (like gold and silver), and binary options for cryptocurrencies. This diversity supports various trading strategies and preferences.

- Exclusive Trading Platform with Fast Execution: The platform is user-friendly, features lightning-fast trade execution, real-time market data, and advanced analytical tools, enabling both manual and automated trading approaches.

- Free, Unlimited Demo Account: Users can practice strategies risk-free with an unlimited-duration demo account, gaining full access to all trading tools and features with no time limits.

- Security and Fund Protection: The broker uses industry-leading encryption, secure payment gateways, and negative balance protection, helping to keep client funds and information safe.

- Educational Resources: Capitalcore provides extensive learning materials such as market insights, daily analysis, webinars, and expert trading strategies, helping traders of all experience levels improve their skills.

- High Payout Percentages and Bonuses: The platform is noted for offering some of the highest payouts in binary options trading, as well as attractive bonuses for traders.

These features combine to make Capitalcore a flexible and accessible platform for traders at all levels, supporting a wide range of trading needs and preferences while providing strong customer support, low costs, and robust educational resources.

Cons

Capitalcore offers some attractive features, but there are several notable drawbacks and potential disadvantages that users should consider:

- Capitalcore is registered in Saint Vincent and the Grenadines and is regulated by the International Financial Services Authentication (IFSA), which is considered a weak regulator, resulting in limited trader safeguards compared to more established regulatory authorities.

- Some sources describe Capitalcore as unregulated and even label it as potentially operating illegally with scam-like behavior, such as pushing cryptocurrency payments (which are harder to trace or recover) and offering unclear terms for bonuses and withdrawals.

- Capitalcore focuses primarily on order execution and lacks advanced trading and research tools such as real-time news feeds, integrated economic calendars, and in-depth analysis from established providers.

- There is no proprietary copy trading service, which is a drawback for beginner traders seeking to follow experienced traders.

- Educational resources are limited to basic written materials, lacking comprehensive tutorials, webinars, and in-depth analysis found with leading competitors.

- The platform offers only around 30 binary options, lagging significantly behind competitors like Quotex that offer hundreds, including stocks and indices.

- Maximum trade durations are capped at one hour, making it less suitable for swing traders who prefer longer time frames.

- During testing, the platform showed unreliable performance, with sporadic technical issues that affected interface loading and usability.

- Payment methods are somewhat limited, and cryptocurrency payments are incentivized, which may raise concerns due to their untraceable nature.

- Bonus offers come with undisclosed or potentially unfair withdrawal conditions, meaning users may find it difficult or impossible to withdraw funds tied to bonuses.

- Unlike some competitors, Capitalcore does not offer interest payments on unused cash reserves, which can be a disadvantage for active traders.

| Drawback | Details |

|---|---|

| Weak regulation and trust issues | IFSA registration, some sources flag as scam/unregulated |

| Lack of advanced trading tools | No copy trading, limited analytics, basic platform features |

| Poor educational resources | Few and basic materials only |

| Limited binary and trading options | Few binaries, short maximum trade durations |

| Technical issues | Reported platform unreliability during tests |

| Unclear or harsh bonus/withdrawal terms | Difficult withdrawal conditions, unclear bonus terms |

| No interest on cash reserves | No passive earnings on idle funds |

Potential users should weigh these risks and disadvantages carefully before choosing to trade with Capitalcore, especially given the regulatory concerns and reports of poor platform transparency and reliability.

Customer Support

Capitalcore offers 24/7 customer support, ensuring clients can receive assistance whenever markets are open. This round-the-clock availability is particularly valuable for traders operating across different time zones.

Email Support

Clients can reach out via email at support@capitalcore.com for more detailed inquiries or issues requiring document attachments. Email responses typically arrive within one business day, making this channel suitable for non-urgent matters requiring thorough assistance.

Phone Support

Capitalcore offers phone support at +1 (623) 920-0100 for clients who prefer voice communication.

Departmental Support

Capitalcore has specialized departments for different types of inquiries:

- Support Department: Email at support@capitalcore.com, Skype at capitalcore.support

- Accounting Department: Email at accounting@capitalcore.com, Skype at capitalcore.accounting