Dukascopy Review

Dukascopy was established on November 2, 2004, in Geneva, Switzerland, by Andre and Veronika Duka, who are Swiss nationals and maintain 99% ownership of the firm.

- 2004: Company founded in Geneva as a specialized trading platform.

- Development of the proprietary trading platform, JForex, which has undergone several iterations and is known for its strong manual and automated trading features.

- Expansion to include additional platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Growth to support over 400,000 clients worldwide, offering services in 22 currencies across more than 150 countries.

- Diversification of services to include modern neo-banking solutions, business accounts, and White Label/banking-as-a-platform partnerships.

Account Types

-

Multi-Currency Account (MCA):

- Designed for retail clients with assets below $100,000.

- Facilitates everyday transactions and can operate as a Swiss account with unique IBANs for up to 24 currencies.

- Enables international and local payments, as well as the ability to hold, exchange, and transfer funds among various currencies.

- Includes deposit insurance up to CHF 100,000.

-

Private Banking (Savings) Account:

- Aimed at clients with wealth exceeding $100,000.

- Functions as a "vault" for long-term wealth storage and growth.

- Comes with a dedicated account manager and additional perks for high-net-worth clients.

- Accessible to MCA holders wishing to deposit more than $100,000.

-

Trading Accounts:

- ECN Forex/CFD accounts for live trading.

- Demo accounts available for practice.

- Access to an array of financial instruments including forex, stocks, indices, bonds, commodities, and precious metals.

Banking Options and Services

-

Cards:

- Plastic and virtual cards in EUR, USD, CHF, and GBP.

- Up to four cards can be active at once, combining virtual and plastic options, and delivered globally to over 150 countries.

- Compatible with Apple Pay, Samsung Pay, and Google Pay.

-

Payments:

- Automated international and local payments.

- Each currency account is assigned a unique IBAN.

-

Mobile Banking:

- A comprehensive mobile app (Dukascopy Connect 911) for secure banking and personal identification.

-

Investment Options:

- Access to a wide range of investment products such as stocks, indices, bonds, precious metals, and commodities.

Key Features

- Account opening available remotely via video identification (24/7 service).

- Deposit insurance up to CHF 100,000 under Swiss deposit protection regulations.

- Tailored support for private banking clients.

- Security and privacy adhering to Swiss standards.

Dukascopy delivers extensive banking and trading solutions for both retail and high-net-worth clients, with strong capabilities in multi-currency management, investment options, and international payments, all supported by Swiss deposit protection and worldwide accessibility.

Leverage

Dukascopy provides a variety of leverage options for traders based on asset class, account size, and trading hours.

Default and Customizable Leverage

- Default Leverage: Dukascopy generally sets leverage at 1:100 during regular trading hours on both MT4 and JForex platforms, allowing traders to control positions up to 100 times their equity.

- Adjustable Leverage: Traders may request modifications to their leverage settings, with predefined options from Dukascopy. Leverage levels such as 1:50 or 1:20 are available, and upon request, it may be increased to as much as 1:200, subject to account equity and risk considerations.

Special Conditions

- Weekend Leverage: Over the weekend and on non-business days, the default leverage is restricted to 1:50. Clients may request an increase to 1:100 if their equity is lower than $50,000.

- Large Accounts: For accounts with substantial equity, the maximum permitted leverage is decided in consultation with Dukascopy before the account is opened.

- Cryptocurrencies and Riskier Assets: Leverage for cryptocurrencies typically caps at 1:5 due to their high volatility.

- Instrument-Specific Margins: Certain instruments may entail higher margin requirements, implying lower leverage according to their risk profile.

Margin and Risk Management

- Margin Call Territory: When leverage utilization reaches 100%, the account enters margin call territory, at which point traders cannot increase their exposure.

- Margin Cut-Off: If leverage utilization hits 200% or more, Dukascopy may automatically decrease open positions to restore leverage to safer levels.

| Condition/Asset | Maximum Leverage | Notes |

|---|---|---|

| Regular Forex Trading (default) | 1:100 | Default rate, set at account opening |

| By request (selected clients) | Up to 1:200 | Subject to approval & conditions |

| Weekend/Off-market | 1:50 (default), 1:100 (upon request) | For equity under $50,000 for 1:100 |

| Cryptocurrencies | 1:5 | Increased margin due to volatility |

| Other specific instruments | Varies | Verification of terms may be required |

In conclusion, Dukascopy offers flexible leverage options for traders, ranging from no leverage (trading solely with deposited funds) up to 1:200 by special arrangement, all while implementing careful risk and margin management practices.

Asset Types

Dukascopy affords traders access to a diverse array of asset classes and financial markets, allowing for portfolio diversification across multiple instruments and markets within a single platform:

Asset Types Available for Trading

- Forex – Spot trading available for major, minor, and exotic currency pairs

- Metals – Precious metals such as gold and silver

- Commodities – Including energy products (e.g., Brent oil, light crude, diesel, gas) and soft commodities (e.g., copper, orange juice, soybeans, cotton, sugar, cocoa, coffee)

- Indexes – CFDs on major global indices (e.g., USA30, USA500, USATECH, JPN, DOLLAR indexes)

- Stocks – US stocks and global stock CFDs

- ETFs – Exchange-traded funds from leading providers like Invesco, Deutsche Bank, Vanguard, and BlackRock

- Bonds – CFDs on US Treasury bonds and other government bonds

- Cryptocurrencies – Major cryptocurrencies and crypto CFDs

- Binary Options – On currencies, indices, and commodities

Markets Covered

- Foreign exchange (currency) markets

- Precious and industrial metals markets

- Commodity markets (energy, agricultural, soft commodities, etc.)

- Equity markets (stocks and ETFs)

- Global stock indexes

- Bond markets

- Cryptocurrency markets

- Binary options markets

Platform Features

- Unified platform access to all markets

- ECN (Electronic Communication Network) model facilitating transparent price discovery and deep liquidity

- Leverage options available (up to 1:10 for ETFs, with tailored solutions also possible)

- Professional asset management services for ETFs

- Capability to use part of an asset's value as collateral for further trading or investment activities

With over 1,200 tradable instruments across a variety of asset classes, Dukascopy provides a broad range of options for both retail and institutional traders to implement varied investment strategies in global financial markets.

Platforms

Dukascopy offers a comprehensive suite of trading platforms and tools, catering to traders with different experience levels and preferences. Below is a summary of the primary offerings:

Trading Platforms

- JForex 4: This flagship platform supports trading across more than 1200 instruments, including forex, cryptocurrencies, indices, stocks, bonds, energy, commodities, and ETFs. It provides advanced charting, JCloud integration, chart replay functionality, and robust order management capabilities (including position reverse/double and new order types). JForex 4 accommodates both manual and automated trading, making it suitable for algorithmic and discretionary traders.

- JForex 3: An earlier iteration of Dukascopy’s in-house platform, JForex 3 also features advanced order types, access to the Swiss Forex Marketplace (SWFX), and the ability to rapidly react to market movements. Its interface allows for extensive market monitoring, order management, and equity tracking.

- MetaTrader 4 (MT4) & MetaTrader 5 (MT5): These well-known platforms are available for clients who prefer a more familiar trading environment. MT4 and MT5 support trading of up to 108 assets and are acclaimed for their robust charting tools, technical analysis capability, and automated trading through Expert Advisors (EAs).

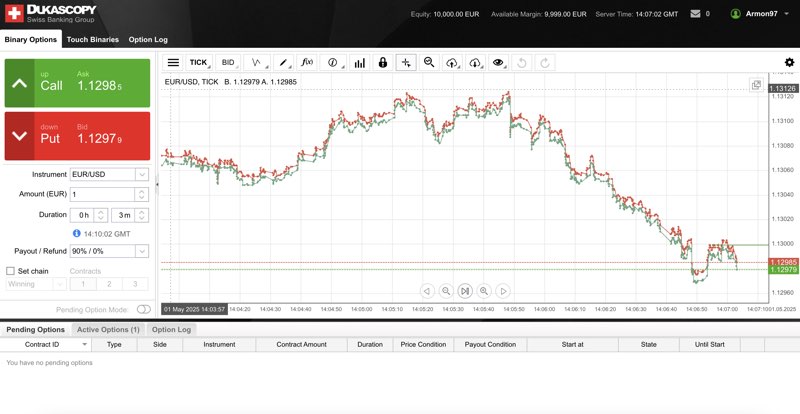

- Binary Options Platform: Dukascopy provides a dedicated platform for binary options trading, offering a unique approach and risk profile relative to traditional CFD or forex trading.

Key Tools and Features

- Order Types Support: The platforms accommodate numerous order types including Market, Limit, Stop, Take Profit, Stop Loss, Stop Limit, Trailing Stop, Place Bid/Offer, OCO (One Cancels Other), and IFD (If Done), enhancing flexibility and risk management options.

- Trading Modes: Both “Net Position” and “Hedging” modes are available. “Hedging” allows for holding both long and short positions on the same instrument, while “Net Position” consolidates trades per instrument.

- Slippage Control: Users may manage maximum price slippage on executions, which is an essential feature for risk-sensitive traders.

- Automation and Strategy Development: Particularly on JForex platforms, users can create and implement automated trading strategies utilizing advanced backtesting and programming interfaces.

- Comprehensive Asset Coverage: The platforms give access to eight asset classes and over 1200 instruments, including forex, crypto, stocks, indices, commodities, ETFs, bonds, and energy.

- Mobile and Web Access: All platforms provide cross-device compatibility, permitting trading from desktop, web, and mobile terminals.

| Platform | Instruments | Automated Trading | Order Types | Custom Features |

|---|---|---|---|---|

| JForex 4 | 1200+ | Yes | Extensive (market, limit, stop, etc.) | JCloud, Chart Replay, Slippage Control |

| JForex 3 | Comprehensive | Yes | Extensive | Advanced order management |

| MT4 & MT5 | Up to 108 | Yes | Standard (market, limit, stop, etc.) | Standard MetaTrader features |

| Binary Options | Varies | No | Binary-specific | Binary options trading |

Dukascopy excels in offering a diverse selection of platforms, a broad range of trading instruments, and robust automation and risk management functionalities, making it a versatile option for both retail and institutional traders.

Fees

Trading Fees

- Spreads: Dukascopy features variable spreads that start from as low as 0.1 pips on major forex pairs.

- Commissions: Standard commissions for forex typically range between $7.00 and $8.00 per 1.0 standard round lot (100,000 units). For MetaTrader 4 (MT4) accounts, the commission is $0.5 per 1 MT4 lot, equating to $5 per $1 million traded.

- Swap Rates: These apply to leveraged positions held overnight, with costs or gains influenced by market conditions and specific instruments.

- Currency Conversion Fees: Fees for currency conversion vary from 0.05% to 1.00% of the transaction amount.

Non-Trading Fees

-

Deposit Fees: While there are no internal deposit fees for payment cards, partner banks may impose commissions based on currency:

- 1.2% for EUR, GBP, CHF

- 1.5% for NOK, CZK, PLN, SEK

- 2% for USD

- 2.3% for JPY, CAD

- Withdrawal Fees: Outgoing wire transfers may incur charges from partner banks, depending on currency and destination, while requesting a withdrawal through the "request funds" service incurs a 3.0% fee.

- Inactivity Fees: Inactive accounts may be subject to inactivity fees, starting at CHF 500 but not exceeding the account balance.

- Maintenance Fees: Trading accounts remain free from maintenance fees for the first 360 days post-opening. Afterward, maintenance fees may apply unless the client has maintained at least one open position during that time. The maximum maintenance fee is EUR 40 per year per client.

Sample Fee Breakdown

- Trading 1,000,000 USD/CAD with MT4: The commission would amount to $18 (based on a $1 x 18 volume commission calculation).

- Outgoing wire transfer: Fees vary by currency, ranging from 7.5 EUR to 50 USD, 80 PLN, etc.; internal transfers within Dukascopy Europe or Group are fee-free.

Dukascopy Core Fees

| Fee Type | Amount/Range | Notes |

|---|---|---|

| Spread | From 0.1 pips | Variable, based on the instrument |

| Commission (standard) | $7–$8/round lot | On 100,000 units traded |

| Commission (MT4) | $0.5 per 1 MT4 lot ($5 per $1 million) | For trades on MT4 platform only |

| Deposit Fee | 1.2%–2.3% | Card deposits, varying by currency |

| Withdrawal Fee | Varies/3% (request funds) | Dependent on method and currency |

| Currency Conversion | 0.05%–1.00% | Applicable to conversions |

| Inactivity Fee | Min CHF 500 (not exceeding balance) | For inactive accounts |

| Maintenance Fee | EUR 0–40/year | Post 360 days, waived with active trading |

Users are encouraged to consult Dukascopy's official fee schedules for precise and current information, as fees may vary according to account type, trading platform, and funding method.

Pros

Dukascopy stands out as a Swiss online banking and brokerage house, providing a wide range of financial and trading services. Key advantages of using Dukascopy include:

Trading Technology & Platforms

- Advanced ECN Environment: Dukascopy utilizes its proprietary Swiss FX Marketplace (SWFX) ECN solution, connecting to more than 20 banks via FIX API. This ensures deep liquidity, rapid order execution, and minimal slippage, suitable for both high-frequency and algorithmic traders.

- No Dealing Desk (NDD): Trades are executed automatically without dealer intervention or requotes, ensuring transparency and fairness for all market participants.

- Multiple Platforms: Various options including MT4, MT5, and the sophisticated JForex 4 platform equipped with over 250 indicators, 10+ order types, chart trading, back-testing, advanced risk management tools, and a Visual Strategy Builder for algorithmic trading.

- Algorithmic Trading: Comprehensive support for automated trading through FIX API, JForex API, and advanced back-testing tools. This appeals to quantitative and tech-savvy traders.

Wide Range of Assets & Innovative Features

- Comprehensive Asset Selection: Trade over 1,200 assets across eight classes, including Forex, CFDs, stocks, bonds, commodities, precious metals, indices, and cryptocurrencies.

- Unique Gold-Denominated Accounts: These allow for diversification and protection through gold holdings in accounts.

- Cryptocurrency Flexibility: Borrow against up to 50% of BTC and ETH values held, providing instant liquidity without restrictions.

Banking & Payment Solutions

- Swiss Bank Security: As a licensed Swiss bank, client deposits are insured up to CHF 100,000 according to Swiss regulations, ensuring enhanced safety.

- Multi-Currency Accounts: Manage up to 24 currencies within accounts, each assigned a unique IBAN. This expedites international transfers and currency conversions.

- Flexible Card Options: Choose from up to four active cards (both virtual and plastic) in multiple currencies, fully compatible with major payment platforms, and globally deliverable to over 150 countries.

Service & Community

- 24/5 Customer Support: Round-the-clock assistance via online chat, phone, and through the proprietary Dukascopy Connect 911 app.

- Strong Trading Community: Access to a multilingual, engaged community featuring forums, strategy contests, and social aspects.

- Rich Educational Resources: Free access to financial news, analysis, and educational material through Dukascopy TV and community offerings.

| Advantage | Description |

|---|---|

| Swiss Banking Security | Deposit protection up to CHF 100,000 and stringent regulatory oversight |

| ECN/NDD Trading | Direct market access, no dealing desk, ensuring fair execution without requotes |

| Advanced Trading Platforms | Compatibility with MT4, MT5, and JForex, with powerful features catering to all trader preferences |

| Wide Asset Coverage | Trade over 1,200 instruments, including forex, CFDs, stocks, and cryptocurrencies |

| Algorithmic Trading & APIs | Comprehensive APIs and tools for automated and high-frequency trading |

| Innovative Account Options | Gold-denominated and multi-currency accounts along with crypto-backed loans |

| Flexible Banking & Cards | Multi-currency IBANs, up to four cards, global delivery, and app-based banking options |

| Active Community & Education | Contests, sharing of strategies, and thorough educational resources |

In summary, Dukascopy is distinguished by its secure Swiss banking environment, advanced trading technology, diverse asset selection, and innovative features tailored for both retail and institutional traders.

Cons

- Complex Platform for Beginners: Dukascopy's platforms and features may be complex, requiring a more extended learning period, potentially posing a challenge for novice traders who prefer simpler platforms.

- Higher Fees for Certain Transactions: Although Dukascopy maintains transparent fees, some transaction methods—particularly bank transfers and card transactions—can entail higher fees compared to certain competitors.

- Limited Trading History Access on Platform: Dukascopy’s platform may not present trading history as conveniently as MetaTrader 4 or 5, which could inconvenience frequent reviewers of past trades.

- Restrictions for Specific Countries: Dukascopy imposes limitations on accounts from several states, including Belgium, Israel, Russia, Turkey, Canada, and the UK, limiting access for residents in those jurisdictions.

- Resource-Intensive Website: Some users find the Dukascopy website to be resource-heavy and slow to navigate, which may lead to less-than-ideal user experiences on lower-end devices or slower internet connections.

- Limited Cryptocurrency Selection: While Dukascopy offers some major cryptocurrencies like BTC/USD and ETH/USD, the total selection is rather limited compared to specialized crypto exchanges.

- Lower Leverage than Some Competitors: Dukascopy caps maximum leverage at 1:200 for ECN accounts and 1:100 for MetaTrader accounts, potentially lower than what's offered by certain other brokers.

- Deposit and Withdrawal Concerns: Overall client feedback on the deposit and withdrawal process shows variability, suggesting not all clients have equally suitable experiences with the available methods.

- Difficult Account Opening Process: User reports indicate that establishing a live account can often be excessively complicated, with issues regarding verification codes and slow customer support responses to resolve such matters.

Customer Support

Dukascopy provides 24/7 customer service for clients, offering continuous trading assistance and general client support services. Customers can reach out for help at any time, including weekends and holidays.