Nadex Review

The North American Derivatives Exchange (Nadex) is based in Chicago and focuses on binary options, call spreads, and knock-out contracts. It offers a regulated and user-friendly platform for trading a diverse range of financial derivatives, catering mainly to retail investors.

- 2004: Nadex was initially established as “HedgeStreet” in San Mateo, California, with the goal of creating an electronic marketplace for retail investors to trade financial derivatives.

- 2007: HedgeStreet halted operations after three years.

- 2008: IG Group Holdings plc, a UK financial services firm, acquired HedgeStreet for $6 million, moved the business to Chicago, and relaunched it under new management.

- 2009: The exchange was renamed the North American Derivatives Exchange (Nadex).

- 2010: The CFTC issued revised registration orders for DCO/DCM, permitting Nadex to clear trades facilitated through Futures Commission Merchant (FCM) members, in addition to direct retail trading members.

- 2013: Leadership transition occurred with Yossi Beinart stepping down as CEO and Timothy McDermott taking over the role.

- Recent Years: Nadex joined the Crypto.com global brand, enhancing its market presence.

Changes in Ownership and Management

- IG Group Acquisition: In 2008, IG Group Holdings plc purchased the company, restructuring the exchange and its offerings.

- Leadership Changes: The CEO succession involved Yossi Beinart followed by Timothy McDermott in the 2010s.

- Current Affiliation: Nadex is now part of the Crypto.com global brand. Historically, it has been associated with IG Group.

Regulatory Status

- Nadex is a regulated financial exchange in the United States.

- Licensing Authority: The primary regulator overseeing Nadex’s operations is the Commodity Futures Trading Commission (CFTC).

- Exchange Designations: Nadex functions as both a Designated Contract Market (DCM) and a Derivatives Clearing Organization (DCO).

- License Numbers: Specific CFTC registration or license numbers are not provided in the available sources.

- Member Fund Safeguards: All member funds are securely held in segregated accounts at major U.S. banks to ensure safety and regulatory compliance.

Account Types

Nadex predominantly offers a single live account type for all traders, granting access to its range of products, including binary options, knock-outs, and call spreads. Additionally, Nadex provides a demo account for traders to practice and test their strategies.

-

Live Trading Account: This is the primary account for trading on Nadex. All traders utilize the same features and products with this account, with no distinctions like "standard," "pro," or "premium" tiers.

Key Features:- No minimum deposit is necessary to open an account; you can set up a live account for free.

- Traders must have the full amount of maximum risk for each trade in their account before placing an order. No leverage is offered: traders can only risk the cash in their account, enabling limited risk exposure with no margin calls.

- Available to residents of the U.S. and selected other eligible countries.

-

Demo Account: Nadex provides a $10,000 virtual demo account, which allows traders to practice trading, test strategies, and familiarize themselves with the platform. This is accessible on both the web platform and the mobile app.

Key Features:- Practice with virtual funds, eliminating the risk to real money.

- Resettable balance for continuous training and testing.

- Same market access and product availability as the live account.

Banking Options: Deposits and Withdrawals

-

Deposit Options:

- Bank Transfer via Plaid (ACH): U.S. customers can deposit funds without charges using Plaid, which connects directly with their bank. A 5-business day withdrawal hold follows funding from a new bank account due to ACH clearing durations.

- Other Funding Methods: Nadex offers additional methods for deposits and withdrawals for both U.S. and international members, although details can be found on their funding page.

- Withdrawal Options: Withdrawals to bank accounts (post the initial 5-day hold for new accounts) are also free for U.S. customers.

- Account Verification: Verification is mandatory for all deposit and withdrawal methods, including bank accounts and debit cards.

Products Available for Trading

- Binary Options

- Knock-Outs

- Call Spreads

These products can be traded across various markets, including major stock indices, forex, and commodities, all through the same account.

| Account Type | Minimum Deposit | Products | Demo Available | Banking Options |

|---|---|---|---|---|

| Live Trading Account | None | Binary Options, Knock-Outs, Call Spreads | No | Bank Transfer (ACH/Plaid), other methods per funding page |

| Demo Account | None | Same as Live | Yes ($10,000 virtual) | Not applicable |

Leverage

Nadex offers several trading options that provide leverage for traders. Though Nadex does not explicitly provide traditional leverage as offered by margin-based trading platforms, it delivers binary options and Bull Spread contracts that permit traders to take positions with controlled risk and the potential for high returns relative to invested capital.

Binary Options

Nadex Binary Options allow traders to predict the direction of an underlying market with a fixed risk and reward profile. Each contract is worth $100, meaning the maximum potential profit or loss is known before the trade is executed. For instance, if a trader purchases a binary option for $30, the potential profit is $70 if the trade concludes in-the-money (excluding fees). This fixed-risk structure may be viewed as a form of leverage, as traders can potentially achieve significant returns with a smaller initial investment.

Bull Spreads

Nadex provides Bull Spread contracts, which offer a high level of effective gearing in relation to traditional spot FX markets. These spreads are tailored for directional trading, enabling traders to benefit from price movements in various currency pairs. Each spread contract is priced based on the underlying spot rate, allowing traders to modify their position size and leverage according to their market outlook.

Leverage Strategies

While Nadex does not offer traditional leverage like margin trading, traders can employ strategies such as strangles and spreads to manage risk and boost potential returns. These strategies enable traders to position themselves on both sides of the market, potentially reaping benefits from larger market movements while mitigating downside risk.

Asset Types

Nadex (North American Derivatives Exchange) facilitates trading across a wide range of asset classes and markets through fixed-risk contracts such as binary options, call spreads, and knock-outs. Here’s an overview of the assets and markets available for trading on Nadex:

Asset Classes and Markets Available

- Forex (Foreign Exchange):

- Major currency pairs can be traded via binary options, call spreads, and knock-outs, allowing speculation on global currency movements without owning the underlying assets.

- Stock Indices:

- Contracts based on major global indices, including:

- Dow (CBOT E-mini Dow® Index Futures)

- S&P 500 (CME E-mini S&P 500® Index Futures)

- Nasdaq 100 (CME E-mini Nasdaq 100® Index Futures)

- Russell 2000 (CME E-mini Russell 2000® Index Futures)

- China A50 (SGX FTSE Xinhua China A50® Index Futures)

- FTSE 100 (ICE Futures Europe® FTSE 100® Index Futures)

- DAX (Eurex DAX® Index Futures)

- Nikkei 225 (SGX Nikkei 225® Index Futures)

- Contracts based on major global indices, including:

- Commodities:

- Commodities are categorized as follows:

- Metals:

- Gold (based on COMEX/NYMEX® futures)

- Silver (based on COMEX/NYMEX® futures)

- Energy:

- Crude Oil (based on NYMEX® futures)

- Natural Gas (based on NYMEX® futures)

- Metals:

- Commodities are categorized as follows:

- Economic Events:

- Nadex also provides contracts allowing traders to speculate on outcomes of specific economic events, such as government reports and economic indicators.

Types of Contracts Offered

- Binary Options

- Call Spreads

- Knock-Outs (Touch Brackets™)

| Asset Class | Underlying Markets/Examples | Contract Types |

|---|---|---|

| Forex | Major currency pairs | Binary options, Call spreads, Knock-outs |

| Stock Indices | Dow, S&P 500, Nasdaq 100, Russell 2000, China A50, FTSE 100, DAX, Nikkei 225 | Binary options, Call spreads, Knock-outs |

| Commodities | Gold, Silver, Crude Oil, Natural Gas | Binary options, Call spreads, Knock-outs |

| Economic Events | Various government and economic indicators | Binary options |

Nadex traders gain access to global markets with well-defined risk profiles across a variety of underlying assets, without having to own the actual instruments.

Platforms

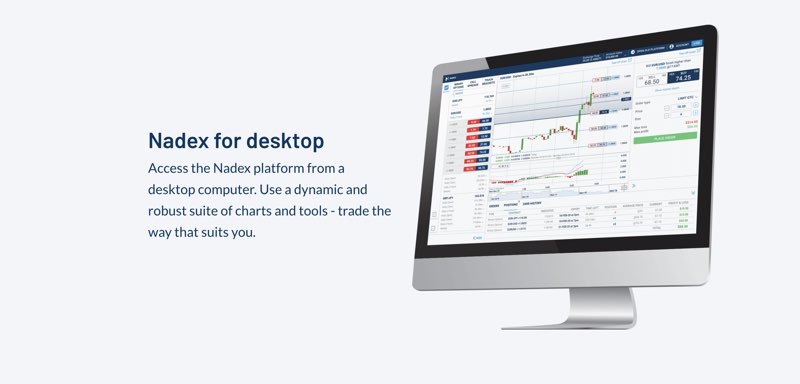

Nadex provides a selection of trading platforms and tools designed for both desktop and mobile users, accommodating various trading styles including binary options, call spreads, and knock-outs.

- Nadex Desktop Platform: Users can trade directly from a desktop browser, utilizing a comprehensive array of charts, technical indicators, and drawing tools for detailed market analysis and trade management. The platform supports trading across forex, indices, and event contracts with expiry durations ranging from 5 minutes to weekly contracts.

- NadexGO™ Mobile App: NadexGO is a mobile trading app founded on Progressive Web App (PWA) technology, enabling traders to access markets, place trades, and manage accounts from smartphones and tablets. The app includes full-featured charts, drawing tools, technical indicators, and access to all Nadex products (binary options, call spreads, knock-outs).

Trading Tools and Features

- Advanced Charting: Both desktop and mobile platforms include dynamic charts with customizable technical indicators and drawing tools, allowing users to conduct technical analysis and personalize their trading experience.

- Technical Indicators: Users can add or personalize a variety of indicators directly on Nadex charts to facilitate decision-making.

- Drawing Tools: The platforms offer multiple drawing tools for chart marking, assisting in trend and pattern analysis.

- Market Access: Quickly filter and access markets by asset class (forex, indices, events), select between trading binary options, call spreads, or knock-outs, and review available strike prices and expiration times.

- Demo and Live Accounts: Both platforms enable users to practice trading with demo accounts or switch to live accounts for actual trading, ensuring that all platform features are available in both environments.

| Platform | Device | Key Features |

|---|---|---|

| Nadex Desktop | PC/Web Browser | Comprehensive charting suite, technical indicators, drawing tools, direct market access, trade management |

| NadexGO™ | Mobile (PWA app) | Mobile trading, full-featured charts, technical indicators, drawing tools, on-the-go trading |

Fees

Traders on Nadex can anticipate the following fees and expenses:

Trading Fees

- Per-Contract Trading Fee: Nadex imposes a trading fee of $1.00 per contract per side for every trade executed. This translates to a $1.00 charge upon entering a trade (per contract) and another $1.00 when exiting (if the position is closed before expiration) or on settlement if the contract expires in-the-money.

- Order Placement: There are no charges for placing, canceling, or adjusting orders.

Settlement Fees

- In-the-Money Settlement: For contracts that expire "in the money" (profitable), there is a $1.00 settlement fee per contract.

- Out-of-the-Money Settlement: No settlement fee applies if a contract settles "out of the money" (not profitable).

Other Costs

- Membership Fee: Nadex does not charge a fee to join the exchange.

- Initial Deposit: The minimum initial deposit required to start trading is $250. After this deposit, there are no ongoing minimum balance requirements.

- Inactivity Fee: Nadex has introduced an inactivity fee; however, specifics on the amount and conditions should be confirmed on the Nadex website or via recent notices as this can change over time.

| Fee Type | Amount | When Charged |

|---|---|---|

| Trading Fee | $1.00 per contract per side | When entering and exiting each trade |

| Settlement Fee | $1.00 per contract | Only if the contract settles in the money |

| Order Placement/Amendment | Free | For placing, canceling, or amending orders |

| Out-of-the-Money Settlement | Free | If the contract expires out of the money |

| Membership Fee | Free | For joining the exchange |

| Initial Deposit | $250 minimum | For opening an account |

| Inactivity Fee | Varies | Refer to current Nadex policies |

Market Makers may have different fee structures, but the above applies to standard users. For the most accurate and updated information, please refer to the official Nadex fee schedule or their website directly.

Pros

-

Limited Risk with Transparent Pricing

Nadex contracts—including binary options and knock-outs—feature built-in risk controls. Each order ticket discloses your maximum possible profit and loss upfront, enabling you to understand risks clearly and preventing any losses beyond your investment in a trade. This facilitates straightforward risk management and avoids unexpected losses. -

No Pattern Day Trader Rule

Nadex does not impose the pattern day trader (PDT) rule, allowing flexibility in trade frequency without maintaining a $25,000 account minimum or adhering to limitations on trades per week. -

Accessible, Low-Cost Entry

The relatively low minimum deposit of $250 to initiate a Nadex account renders it accessible compared to conventional trading platforms that often demand higher initial capital. Furthermore, you can trade contracts representing major global markets at a fraction of the cost of directly purchasing those assets. -

Regulated and Transparent Environment

Nadex operates as a regulated exchange under the oversight of the U.S. Commodity Futures Trading Commission (CFTC), which adds a layer of trust and credibility, distinguishing it from many offshore platforms. This assures transparent business practices and reliable fund management. -

Wide Market Access and Flexible Products

Nadex offers a variety of short-term contracts based on stock indices, forex, and commodities. You can trade effectively using binary options, knock-outs, and call spreads, creating opportunities to engage with global markets applying different strategies and timeframes. -

Powerful, User-Friendly Trading Platform

The Nadex platform is easy to navigate, executes trades rapidly, and provides highly customizable charting tools alongside technical indicators and drawing features—facilitating efficient trading from any location. -

Free Demo Account

A free Nadex demo account may be opened, offering $10,000 in virtual funds for practicing and exploring trading strategies without risking actual capital.

Cons

- Limited Product Range: Nadex offers only three types of options (binary options, call spreads, and knock-outs), without access to traditional assets like stocks or forex spot trading. This limitation may deter traders seeking a wider array of financial instruments.

- Complexity for Beginners: The derivatives available on Nadex can be complex financial instruments, making the platform less suited for novice traders. Binary options, in particular, carry a high level of risk and can lead to significant losses if not comprehended properly.

- Limited Research Tools: The platform provides fewer research and analysis resources when compared to traditional brokers. This limitation might pose challenges for traders who depend on comprehensive analytics to guide their choices.

- Higher Entry Threshold and Fees: Starting to trade on Nadex necessitates a relatively high minimum deposit of $250. Alongside this, each trade incurs a $1 commission and a flat $25 fee for fund withdrawals, which can accumulate for frequent traders or those withdrawing lesser amounts.

- Language and Accessibility: The platform’s information is exclusively available in English, which may pose challenges for non-English-speaking users.

- Complex Verification Procedures: Opening an account on Nadex entails a thorough verification process, satisfying U.S. regulatory standards but possibly cumbersome for international users or those seeking swift access.

- Mobile Platform Weaknesses: While the desktop trading experience is user-friendly, the mobile interface is considered subpar, potentially constraining convenience for traders who prefer to manage positions remotely.

- No Direct Asset Ownership: Nadex exclusively offers derivatives, meaning traders do not have ownership of the underlying assets. This could be unappealing for those looking for traditional investment opportunities.

- Risk Profile: The nature of binary options implies an all-or-nothing bet on market direction, which encompasses a substantial risk level. Novices might rapidly lose funds to more seasoned market participants.

| Drawback | Description |

|---|---|

| Limited Product Range | Only three types of options are available; no traditional assets |

| High Risk | Complex, high-risk derivatives; binary options are "all or nothing" |

| Limited Research Tools | Fewer analytics tools compared to traditional brokers |

| Fees | $1 per trade, $25 withdrawal fee |

| High Entry Threshold | $250 minimum deposit is required |

| Language Barriers | Platform only available in English |

| Complex Verification | Detailed regulatory checks for account opening |

| Poor Mobile Experience | Mobile app functionality is less than desktop platform |

| No Asset Ownership | All instruments are derivatives, not direct holdings |

Customer Support

Nadex customer support operates during specific hours rather than continuous availability. Their operational hours are Sunday through Friday from 6:00 PM to 4:15 PM. This distinctive schedule likely aligns with trading hours since markets for stock indices, forex, and commodities are not active during end-of-day processing (Monday to Thursday, 5:00 PM to 6:00 PM ET).

Communication Channels

Email: Customers can contact Nadex at customerservice@nadex.com for general queries, account issues, and further assistance.

Live Chat: A live chat feature is available on their website for immediate support with any questions or concerns.

Phone: Customers can reach Nadex by phone at (312) 884-0100.

Mailing Address: For formal correspondence, customers can send mail to their office in Chicago at: North American Derivatives Exchange, Inc. 200 West Jackson Blvd. Suite 1400 Chicago, IL 60606