AZAforex Review

AZAforex was established in 2016 and identifies itself as an international brokerage service that facilitates trading in Forex, cryptocurrencies, CFDs (including precious metals, energies, stocks, indices), and binary options. The company asserts that it provides brokerage services devoid of trading restrictions or intervention from brokers, featuring elements such as tight spreads, high leverage, and swift execution during significant news releases.

The firm is registered offshore in the Marshall Islands and states that it does not disclose client information to any government agency nor acts as a tax agent.

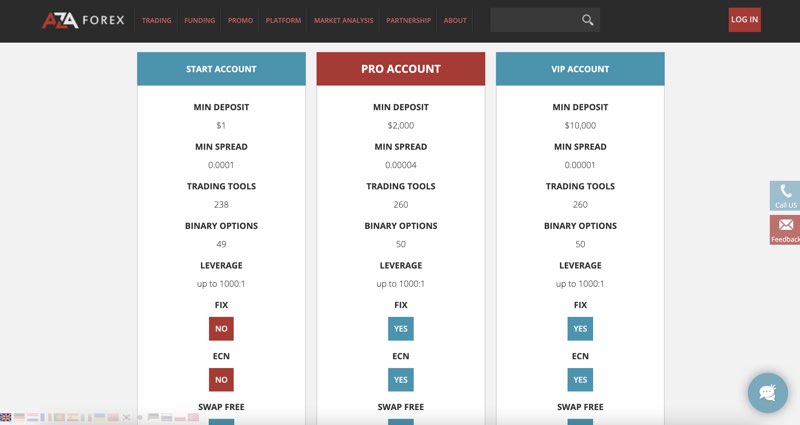

Account Types

-

Start Account:

- Minimum deposit: $1

- Targeted at beginners

- Access to 238 trading instruments and 49 binary options

- Spreads from 1.1

- Rebates & PAMM services for deposits over $100

- Loyalty bonus for deposits over $500

-

Pro Account:

- Minimum deposit: $2,000

- Aimed at more experienced traders

- Access to 260 trading instruments and 50 binary options

- Spreads from 0.5 (includes ECN and fixed spreads)

- Rebates, PAMM services, loyalty program, and $200 deposit bonus

-

VIP Account:

- Minimum deposit: $10,000

- For professional traders

- Same instruments as Pro Account (260 trading instruments, 50 binary options)

- Spreads from 0.1 (tighter spreads)

- ECN and fixed spreads

- Rebates, PAMM services, loyalty bonus, and up to $2,000 deposit bonus

All live account types offer:

- Leverage up to 1:1000

- Swap-free trading

- Access to the same trading platform

Additionally, AZAforex provides demo accounts for practice and PAMM accounts for managed trading services.

Banking Options

- Multiple funding and withdrawal methods available (details typically available after account registration)

- Order volume can start from as low as 0.0001 lot (or $10), with no maximum limit

- Funding options are designed for rapid, delay-free transactions

Additional Features

- Binary options trading available across all account types

- PAMM account services for both investors and traders

- Bonuses, rebates, and loyalty programs depending on account type and deposit size

Leverage

AZAforex offers a flexible range of leverage options for traders, depending on the account type, deposit amount, and the trading instrument selected.

General Leverage Range

- Standard leverage ranges from 1:1 up to 1:500 for most accounts and instruments.

- Leverage can be increased to up to 1:1000 by depositing between $500 and $2,000 and submitting a request in the Client Portal.

- This maximum leverage of 1:1000 is primarily available for major currency pairs.

Leverage by Trading Instrument

- Currency Pairs: Up to 1:500 (1:1000 with special request and deposit requirement).

- Energies (e.g., oil, gas): Up to 1:100.

- Precious Metals (Gold, Silver): Up to 1:200.

Account Types and Leverage

- AZAforex offers several account types (Start, Pro, VIP), all of which can access leverage up to 1:1000, subject to the deposit requirements and approval.

Additional Notes on Leverage

- Leverage for open positions remains fixed at the level set when the trade is opened.

- AZAforex reserves the right to reduce leverage for new positions at its discretion without prior notice.

- Actual leverage available may also be influenced by regulatory requirements in the trader's jurisdiction.

| Instrument | Maximum Leverage | Conditions |

|---|---|---|

| Major Currency Pairs | Up to 1:1000 | Deposit $500-$2,000 and request approval |

| Other Currency Pairs | Up to 1:500 | Standard accounts |

| Energies (Oil, Gas) | Up to 1:100 | Varies by instrument |

| Precious Metals (Gold, Silver) | Up to 1:200 | Varies by instrument |

In summary, AZAforex provides leverage options up to 1:1000 for qualifying traders and up to 1:500 for most standard trading, with specific limits dependent on the traded asset and client profile.

Asset Types

AZAforex presents a wide variety of assets and market types for trading. Here is a breakdown of the main categories available to traders on their platform:

- Forex: Trade over 50 currency pairs, including major pairs (such as EUR/USD), minors (like AUD/NZD), and exotics (for example, USD/MXN).

- Commodities: Access more than 10 commodities, featuring oil, natural gas, and precious metals such as gold.

- Indices: Over 12 major global indices from the US, Europe, and Asia-Pacific (e.g., Nasdaq-100, S&P/ASX 200) are available for trading.

- Stocks: More than 149 CFD stocks from major US and European exchanges, including notable names like Alibaba, Adidas, and Vodafone.

- Cryptocurrencies: 10+ cryptocurrency pairs such as BTC/USD and ETH/USD can be traded.

- Binary Options: Choose from 50+ binary options contracts across various assets, providing up to 90% maximum payouts.

Markets NOT Available on AZAforex

- ETFs: Exchange-traded funds are not available.

- Bonds: Government and corporate bonds are not offered for trading.

- Futures: There are no futures contracts available on the AZAforex platform.

- Passive Investments: No access to real (non-CFD) stocks or copy trading features.

| Asset Class | Examples/Details |

|---|---|

| Forex | 50+ pairs (majors, minors, exotics) |

| Commodities | Oil, natural gas, gold, silver |

| Indices | 12+ (Nasdaq-100, S&P/ASX 200, etc.) |

| Stocks | 149+ CFDs (Alibaba, Adidas, Vodafone, etc.) |

| Cryptocurrencies | 10+ pairs (BTC/USD, ETH/USD, etc.) |

| Binary Options | 50+ contracts; up to 90% payout |

| Not Available | ETFs, Bonds, Futures, Passive investments |

Platforms

AZAforex provides clients with access to modern and advanced trading technology, focusing its services around the Mobius Trader 7 (MT7) platform. Below is a detailed overview of what users can expect from AZAforex in terms of trading platforms and key tools:

Trading Platform

- Mobius Trader 7 (MT7):

- MT7 is a professional and modern trading platform developed to combine the advantages of popular forex trading systems with new technological features.

- The platform supports various user roles, including private traders, PAMM account managers, investors, and corporate representatives.

- Mobius Trader 7 integrates modern blockchain technologies with classic forex trading mechanisms, distinguishing it from traditional platforms like MetaTrader 4 and 5.

Key Trading Tools and Features

- Fast Execution: Ensures timely trade fulfillment for all users.

- VPS (Virtual Private Server): Supports uninterrupted trading even if the user's local device is offline.

- Copy Trading: Allows users to follow and replicate the trades of experienced traders automatically.

- PAMM Accounts: Enables professional money management services and investor participation directly through the platform.

- Multi-asset Trading: Access to a broad spectrum of markets, including Forex, metals, commodities, indices, stocks, and cryptocurrencies.

- Account Types: Multiple account options (Demo, Start, Pro, VIP), catering to different minimum deposit requirements and trading conditions.

Platform Comparison and Flexibility

- MT7 is marketed as a feature-rich alternative to more commonly known platforms such as MT4 and MT5, emphasizing speed, technology, and user roles.

- Mobius Trader 7 enables both novice and professional traders to manage their trading activities effectively with modern analytical and risk management tools.

Support and Accessibility

- AZAforex offers various support channels including phone, email, Telegram, WhatsApp, Skype, and live chat, ensuring users can obtain assistance as needed.

In summary, AZAforex primarily provides the Mobius Trader 7 platform, which is characterized by its technological integration and trading flexibility, supported by fast execution, copy trading, PAMM account feature, and extensive asset coverage.

Fees

Users trading on AZAforex need to be aware of several types of fees and costs, including spreads, account funding, and withdrawal-related charges.

Trading Fees

- AZAforex does not charge direct trading commissions. Instead, costs are embedded in the spread, offering a transparent fee structure.

- Spreads vary by account type:

- VIP Account: from 0.1 pips

- Pro Account: from 0.5 pips

- Start Account: from 1.1 pips

- There are no zero spread options available for any account type.

Deposit and Withdrawal Fees

- AZAforex does not impose fees for deposits or withdrawals.

- However, users are responsible for any third-party payment system fees or miner fees (for cryptocurrencies) related to their transactions.

- International bank wire transfers incur a minimum fee of 20 units of your account’s base currency (e.g., 20 USD), as charged by AZAforex.

- Deposits via bank transfer, credit/debit card, and some e-wallets may incur significant charges, typically 5% to 6% plus a $0.50 processing fee. Some or all of these fees may be waived for larger deposits:

- E-wallets: deposits over $100

- Cards: deposits over $300

- Bank transfers: deposits over $1,000

| Fee Type | Description | Details |

|---|---|---|

| Trading Commission | Built into spread | No separate commission; spreads from 0.1 pips (VIP) to 1.1 pips (Start) |

| Deposit (General) | Third-party fees may apply | 5%-6% + $0.50 for smaller amounts; waived for large deposits |

| Bank Wire Deposit | Bank fee | Minimum 20 units of base currency |

| Withdrawal | Payment system/miner fee only | No AZAforex fee, but user pays any third-party fees |

AZAforex offers a competitive trading cost structure by integrating commissions into the spread and avoiding direct trading fees. However, users should be attentive to potential deposit and withdrawal costs from payment providers and banks, particularly for smaller deposit amounts and specific transfer methods.

Pros

- Ultra-Low Spreads and Competitive Pricing: AZAforex offers very tight spreads beginning from as low as 0.00001 pips, making trading affordable for both novice and seasoned traders.

- Zero Broker Fees: The platform distinguishes itself by charging no broker fees on deposits and withdrawals, enabling traders to keep more of their earnings.

- Fast Order Execution: Orders are fulfilled in as little as 0.01 seconds, with market execution without requotes, ensuring efficient and dependable trade execution.

- Diverse Account Types and Low Minimum Deposits: Traders can select from various account types such as Start, Pro, VIP, and Demo, with minimum deposits beginning from as little as $1, catering to both beginners and professionals.

- Wide Range of Tradable Assets: AZAforex facilitates trading in forex, metals, commodities, indices, stocks, and cryptocurrencies, providing plenty of diversification options.

- High Leverage: Offers leverage of up to 1:1000, suitable for aggressive trading strategies or traders aiming to maximize their capital's efficiency.

- Multiple Deposit and Withdrawal Options: The platform accommodates a broad assortment of base currencies and payment methods, including cryptocurrencies, making it globally accessible for traders.

- Bonuses and Promotions: AZAforex provides significant bonuses—including crypto, loyalty, and no-deposit bonuses—which can assist in increasing trading capital and reducing risk exposure for new users.

- Advanced Trading Technology: Access to the Mobius Trader 7 platform, VPS support, copy trading, and PAMM accounts provide traders with robust tools to execute and automate trading strategies.

- Comprehensive Customer Support: Support is available through various channels such as phone, email, Telegram, WhatsApp, Skype, and live chat, assuring timely assistance for users.

These features combine to make AZAforex appealing for traders seeking flexibility, minimal trading costs, rapid execution, and advanced tools, as well as those interested in bonuses and a variety of funding methods.

Cons

- Lack of Regulation: AZAforex operates as an unregulated broker, raising concerns regarding transparency, safety of client funds, and dispute resolution. This increases risk for traders, as there are no audits by recognized financial agencies.

- Proprietary Trading Platform: The broker employs its own Mobius Trader 7 platform, which may not be as widely acknowledged or independently verified as other platforms like MetaTrader or cTrader. This could trigger apprehensions regarding possible price manipulation and inconsistencies in market data.

- Poor Customer Support: User reviews suggest that AZAforex's customer service is slow to respond, which could be a disadvantage when traders face issues or need prompt assistance.

- Limited Educational Resources: Educational materials are basic, mainly consisting of outdated guides and a blog. There is a lack of extensive resources such as video tutorials, webinars, or interactive tools, making the platform less appropriate for beginners needing structured learning support.

- Limited Asset Coverage for Binary Options: Although AZAforex offers binary options trading, it does not present these instruments on stocks or cryptocurrencies—restrictions limiting choices for traders pursuing binary options diversification.

- Negative User Reviews and Low Ratings: The broker has encountered generally poor ratings from review platforms and clients, with a score of 1.2 out of 5 stars and a low rank in broker evaluations. Many clients have voiced dissatisfaction with their experiences.

- Basic Trading Features: The platform is perceived as lacking compared to competitors in terms of advanced functionality and analytical tools, potentially limiting its appeal to more sophisticated traders.

| Disadvantage | Description |

|---|---|

| Unregulated Broker | Increased risk due to lack of oversight and investor protection. |

| Slow Customer Support | Reports of delayed response times and inadequate assistance. |

| Proprietary Platform Risks | Mobius Trader 7 is not widely used or independently verified, raising transparency concerns. |

| Lack of Robust Education | Limited and outdated learning materials, unsuitable for beginners. |

| Incomplete Asset Coverage | No binary options trading available on stocks or cryptocurrencies. |

| Negative Reviews/Low Ratings | Low scores and general user dissatisfaction. |

| Basic Features for Advanced Traders | Lack of advanced analysis tools and functionality. |

In summary, AZAforex’s principal drawbacks center on its unregulated status, slow customer support, proprietary and less transparent platform, limited educational resources, restricted asset selection for binary options, and generally negative user feedback. These risks and limitations should be thoughtfully considered by potential traders.

Customer Support

- AZAforex provides customer support during extended business hours, specifically from 8:00 a.m. to 8:00 p.m. UTC as stated on their contact page.

- Some sources suggest support availability from 7:00 a.m. to 7:00 p.m. UTC, Monday through Friday, indicating approximately 12 hours per day, five days a week coverage.

Communication Channels

- Live Chat: Available on their website during business hours for real-time support.

- Email: General support can be reached at support@azaforex.com; financial queries should be sent to account@azaforex.com.

- Phone: Clients can call +447700100833 for assistance. This number is also active on WhatsApp.

- Messaging Apps: Support is accessible via WhatsApp, Telegram (@azaforex), and Skype (azaforex.com).

- Contact Form: An online form is available on their website for inquiries, with a commitment to respond promptly.